Home >

Focus on what you care about most, while we handle the administration

Starting or managing a private foundation is no small feat. There are startup costs, ongoing administrative hassles, annual tax filings and more. All too often, the many burdens can pile up and leave you so busy, there's little time or joy left for giving. But it doesn’t have to be that way.

Together, we can make your foundation a driver for impact

Housing a donor advised fund at Toronto Foundation is an ideal alternative to a private foundation. We handle all of the administration, freeing you up to focus on giving back. Plus, our team is here to support you and your family in defining your philanthropic priorities. We’ve been working with people just like you for more than forty years.

We invite you to join our network of over 1,000 donors who’ve chosen to learn about the city’s greatest needs and invest accordingly. We’re strengthening relationships with community every year, building hope and momentum for a better Toronto.

STARTING UP

Toronto Foundation

![]() Less than a week

Less than a week

![]() No cost

No cost

vs.

Private Foundation

![]() 6-12 months

6-12 months

![]() $7,000+ in expenses

$7,000+ in expenses

More comparisons from costs to administration and governance here.

What sets us apart: We make giving simple

Easy Startup

Get started in days. Unlike private foundations, which can take 6-12 months and cost up to $7,000 to launch, our funds have no startup fee and only require a $10,000 minimum balance to start granting — far less than many other DAF providers.

Administration Covered

Our full-service administration includes accounting, audit, legal, receipting, tax filing, governance, compliance and granting. You make the grant decisions and we process the payments on your behalf.

Flexibility

We offer several types of funds. You can permanently endow your money then annually grant out the earned interest or set up a flow through fund to give what and when you want.

Fees that Fuel Community

Our fees are modest and cover comprehensive services in addition to supporting grassroots leadership, research and community impact. Financial institutions are sometimes able to offer lower fees, but their revenues go back to the business and shareholders rather than broader community needs.

Access to high caliber investments

Our investment pooling approach opens the door for many individuals and families to access competitive investments, like private equity, that might otherwise be out of reach.

Year-end solutions

If you are set on a private foundation but won’t make the year end timeline, consider us as a stop-gap solution. You can set up a temporary fund with us in just a few days, securing a current year tax receipt while giving yourself more time to establish a private foundation.

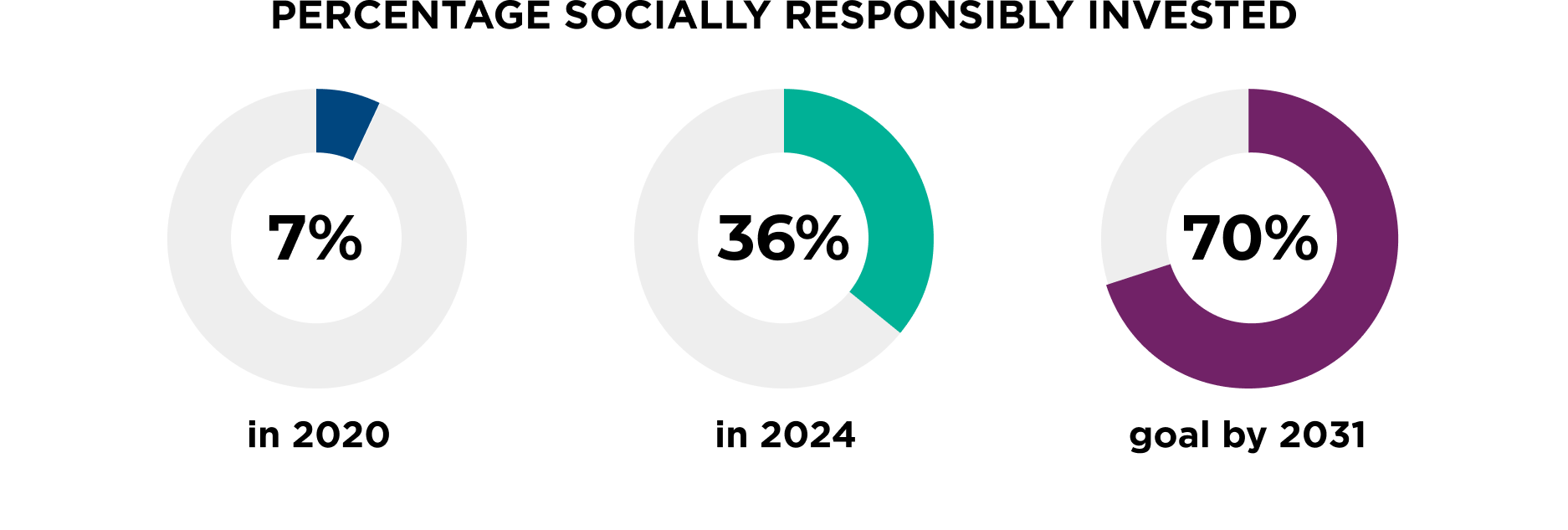

Our Expertise: We know responsible investing

We’re proud to call RockCreek Canada our internationally renowned Outsourced Chief Investment Officer. Founded by the World Bank’s former treasurer and chief investment officer, RockCreek has helped us re-imagine our broader investing strategy for more aggressive, yet responsible, financial returns. Plus, what started with a finance-first agenda with our establishment in 1981, is evolving to match our equity-driven vision that bold financial and social yields can be achieved in tandem. We’re committed to using all of our assets for good.

We know community: insights, connections and commitment

Community foundations are designed and driven to move donations into the communities they serve, while financial institutions ultimately exist to make a profit for shareholders.

Once you’re set up with us, you can give to any Canadian registered charity or qualified donee. If you’re looking for advice on where to give, we can help with that too.

Toronto vital Signs report

For over two decades we’ve produced Toronto’s Vital Signs research to report back on and drive giving towards the city’s greatest needs. We build and maintain relationships with organizations driving solutions so that fundholders have opportunities to better understand the city’s inequalities.

Good to give guides

Each year we make it easier to give where needs are the greatest by producing Good to Give Guides of donation-ready, smaller organizations.

Questions?

Connect with Aneil Gokhale – Director, Philanthropy at Toronto Foundation

416.921.2035 ext. 212