Home >

Our approach: responsible investing

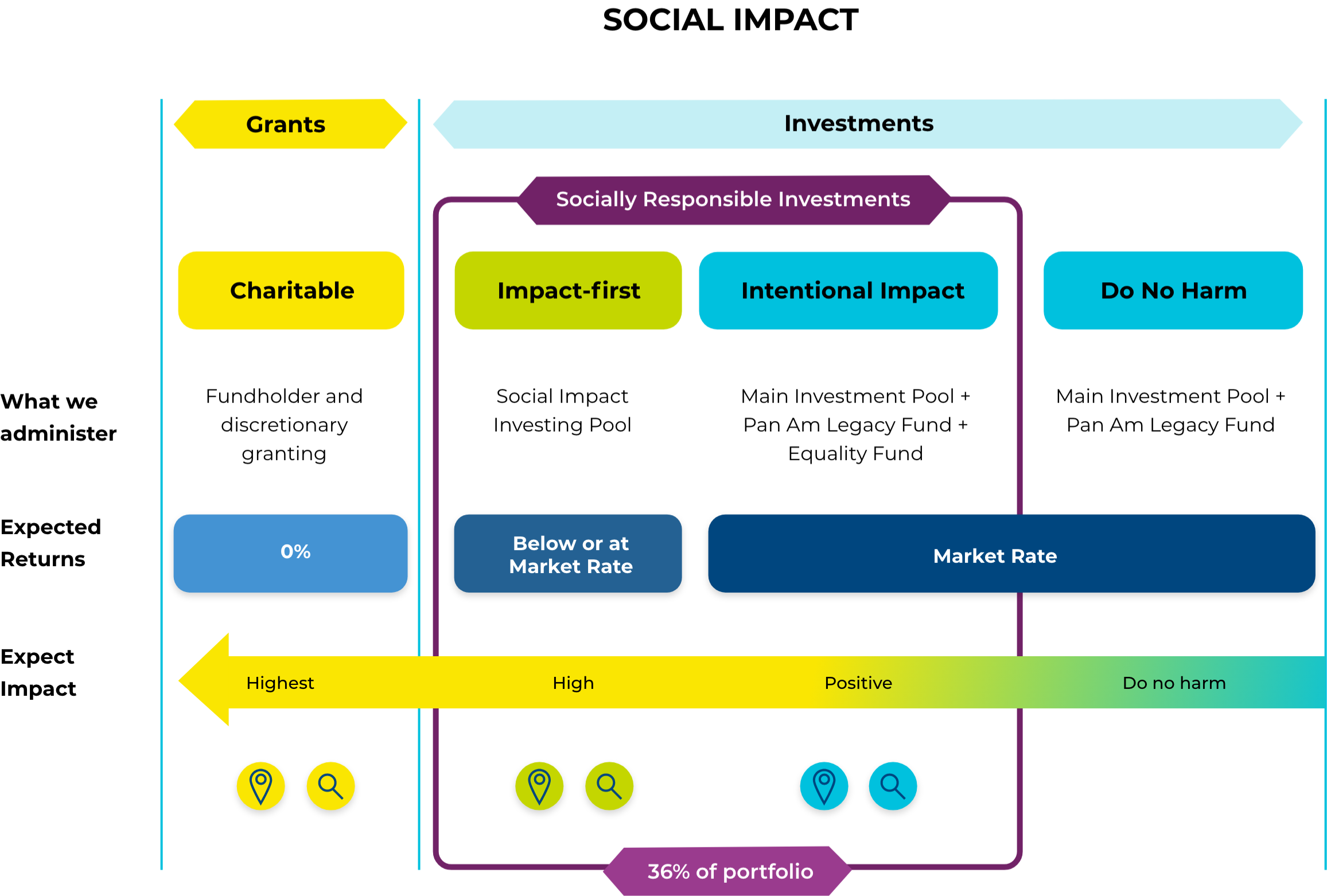

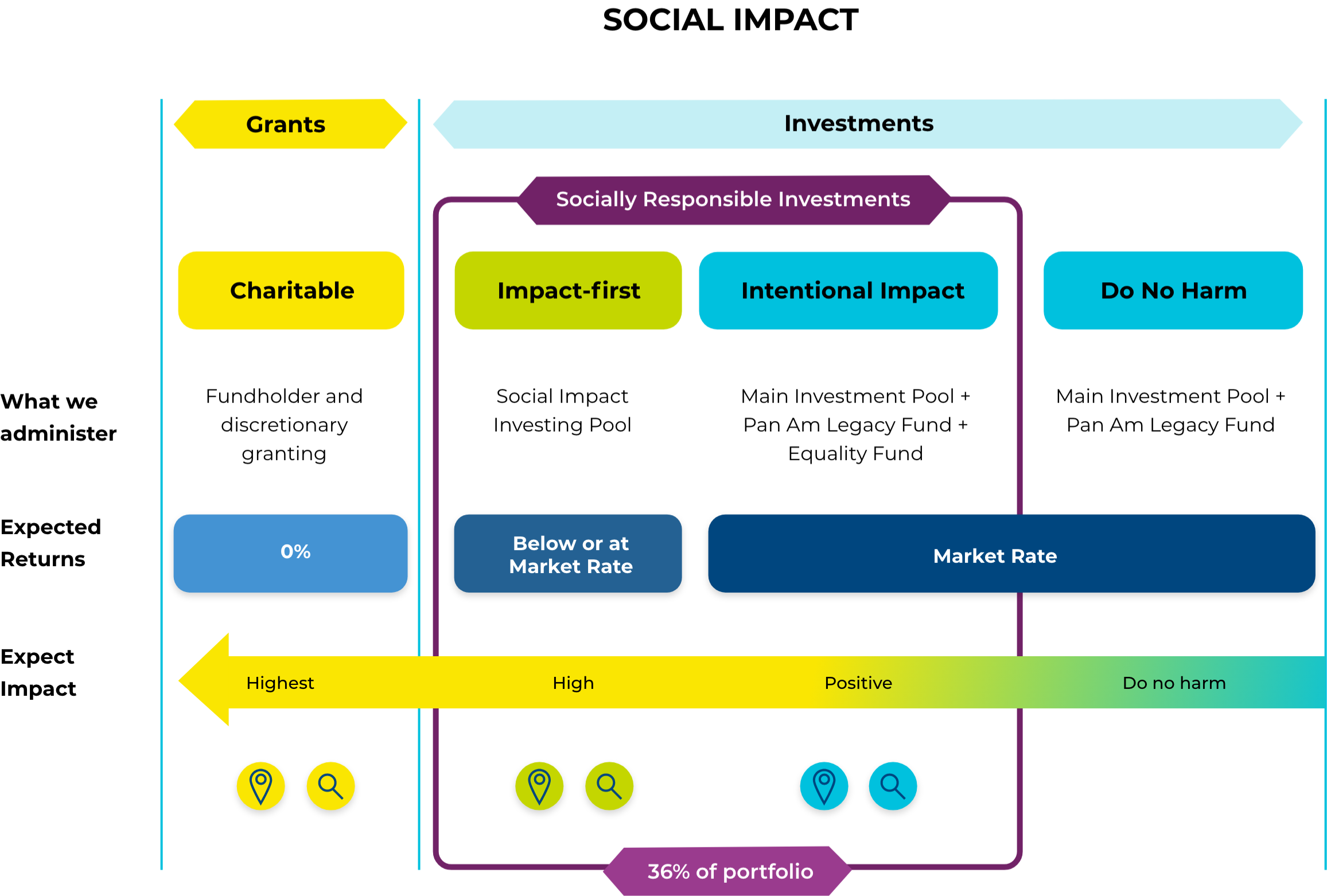

To achieve higher impact and returns more responsibly, Toronto Foundation invests within a spectrum of impact-first to traditional options. Further, we’ve diversified beyond public markets to include more equity within private markets and to invest more responsibly overall.

Our impact evolution

How we got here and why

For years we’ve used an action-oriented and equity-focused research agenda. That informs donor and community engagement designed to disrupt traditional philanthropic practices, including flowing more money to smaller, local and equity-focused organizations. When only 15% of our funds are endowed, our collective impact through fundholder granting matters that much more.

Equity is the central pillar of our discretionary granting. Over the last four years, we’ve disbursed an average of 14.5%, well above the 5% minimum. But more and more we’re looking to integrate impact across all that we do.

From granting to investing and leveraging the capital in between

In 2017 we created a standalone social impact investing pool for groups that needed more money than we could grant and where there was an opportunity to repurpose capital from one social purpose venture to the next.

Then we hired internationally renowned Outsourced Chief Investment Officer, RockCreek Canada, to re-imagine our broader investing strategy for more aggressive, yet responsible, financial returns. What started with a finance-first agenda with our establishment in 1981, started evolving in 2021 to match our equity-driven vision that bold financial and social yields can be achieved in tandem.

As we annually increase the percentage of our assets responsibly invested to our goal of 70%, we can confirm that our full portfolio already adheres to the principle of doing no harm.

Impact continuum

Give charitable gifts

Prioritize social or environmental benefits while also generating financial gains.

Prioritize financial returns while creating social or environmental gain through private strategies and companies.

Proactive approach to incorporating environmental, social and governance ESG factors into investments through public markets.

Geography:

Local (mostly)

Example:

Toronto's Vital Signs Grants

Geography:

Canada

Example:

Windmill

Microlending

Geography:

Global

Examples:

Generate Capital

Equality Fund

Private Debt Fund

Give charitable gifts

Prioritize social or environmental benefits while also generating financial gains.

Prioritize financial returns while creating social or environmental gain through private strategies and companies.

Proactive approach to incorporating environmental, social and governance ESG factors into investments through public markets.

Geography:

Local (mostly)

Example:

Toronto's Vital Signs Grants

Geography:

Canada

Example:

Windmill

Microlending

Geography:

Global

Examples:

Generate Capital

Equality Fund

Private Debt Fund

We’ve also diversified beyond public markets, increasing our equity in private investments to drive deeper, more responsible impact *. Because we know that when we invest responsibly, we help tackle intractable issues like inequality and create lasting wellbeing for all.

*The transition from a traditional portfolio to one invested responsibly typically spans several years. Because certain investments have been locked in for extended periods, it takes time to divest.