Home >

Responsible investment impact

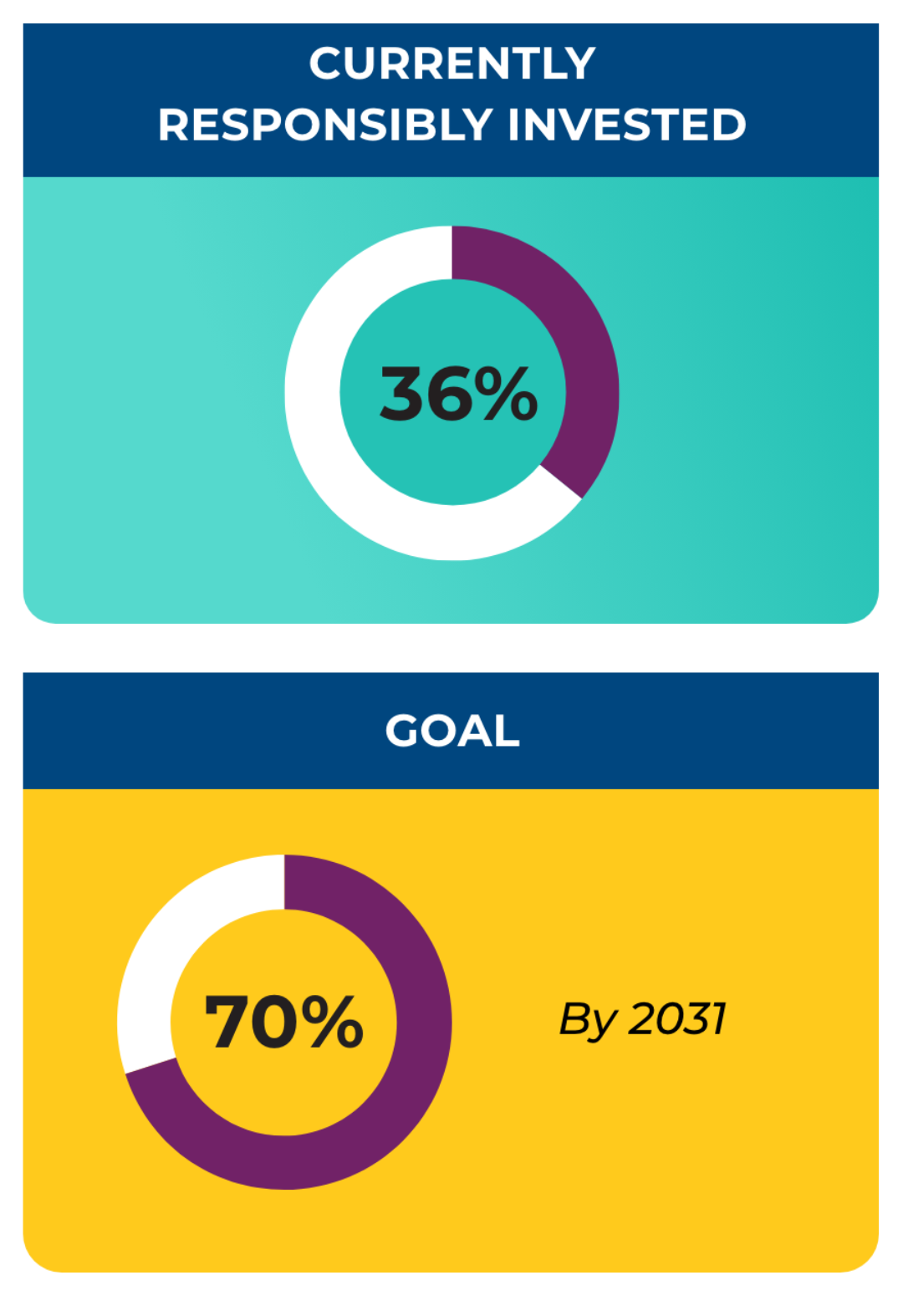

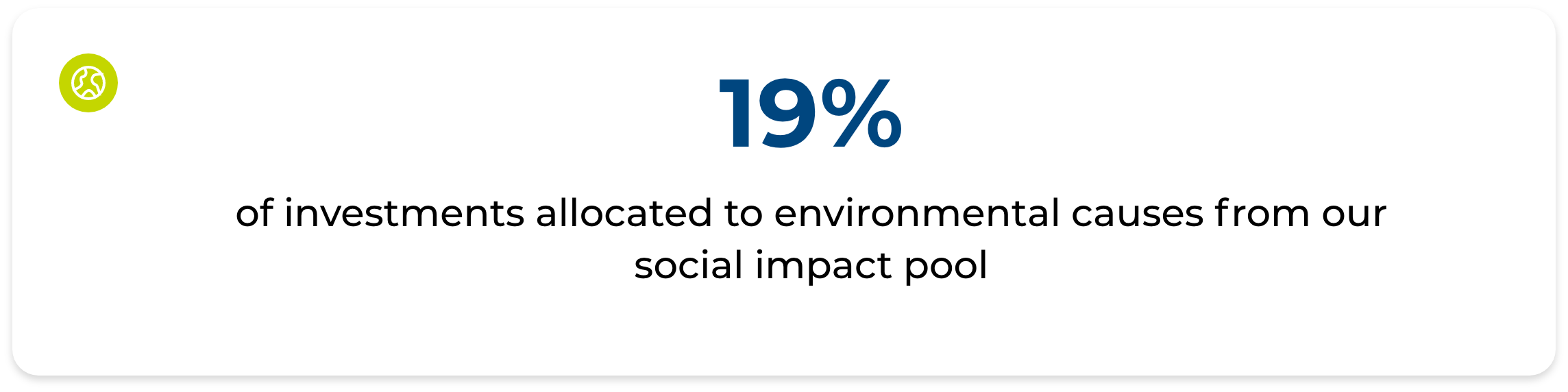

For greater impact, we’re using more of our assets for good

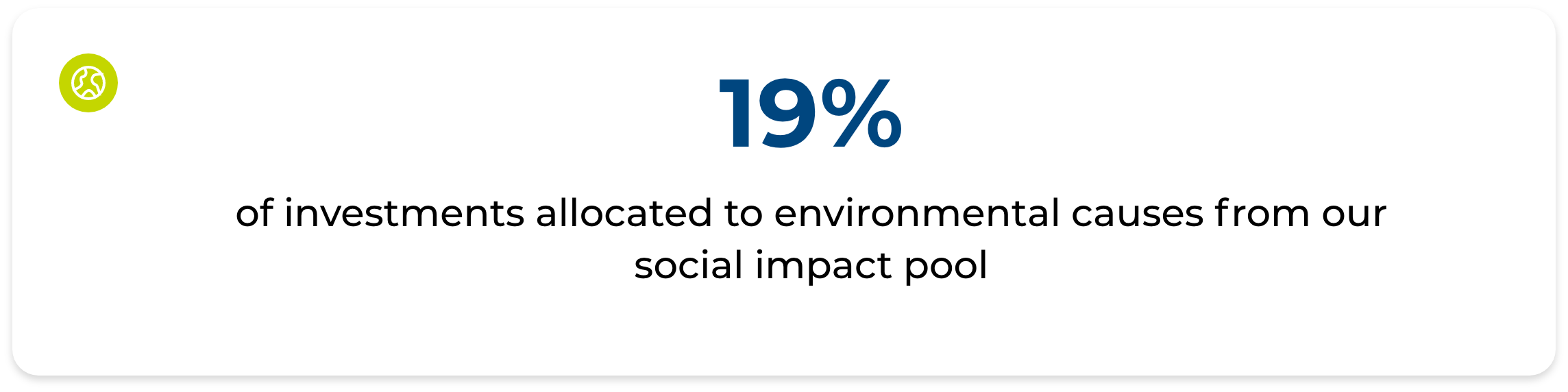

To achieve higher impact and returns more responsibly, Toronto Foundation invests within a spectrum of impact-first to traditional options. Further, we’ve diversified beyond public markets to include more equity within private markets and to invest more responsibly overall*. Below is our 2024 Investment Impact Report outlining key outcomes for our assets as well as those we administer for others. You can read more on the evolution of our impact investing strategy including how we increasingly use our assets for good across an impact continuum here.

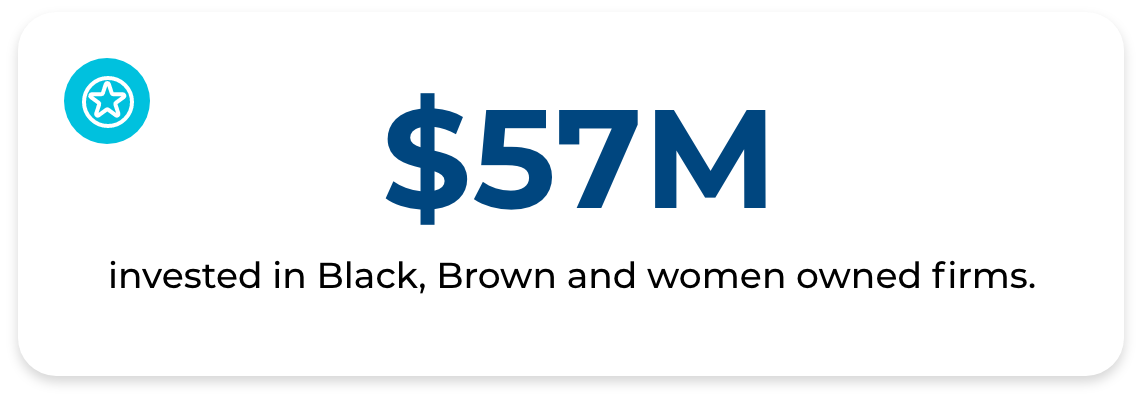

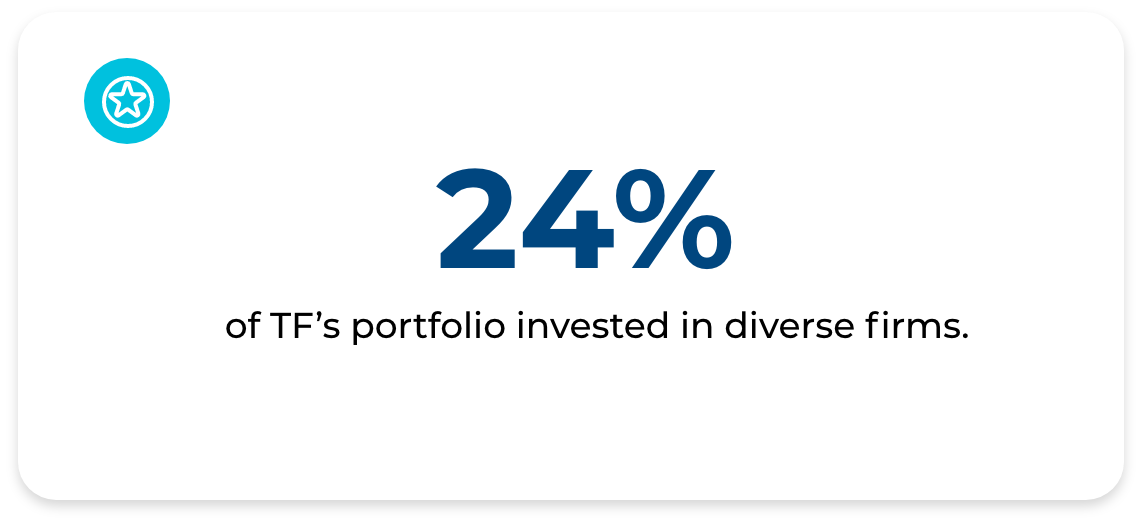

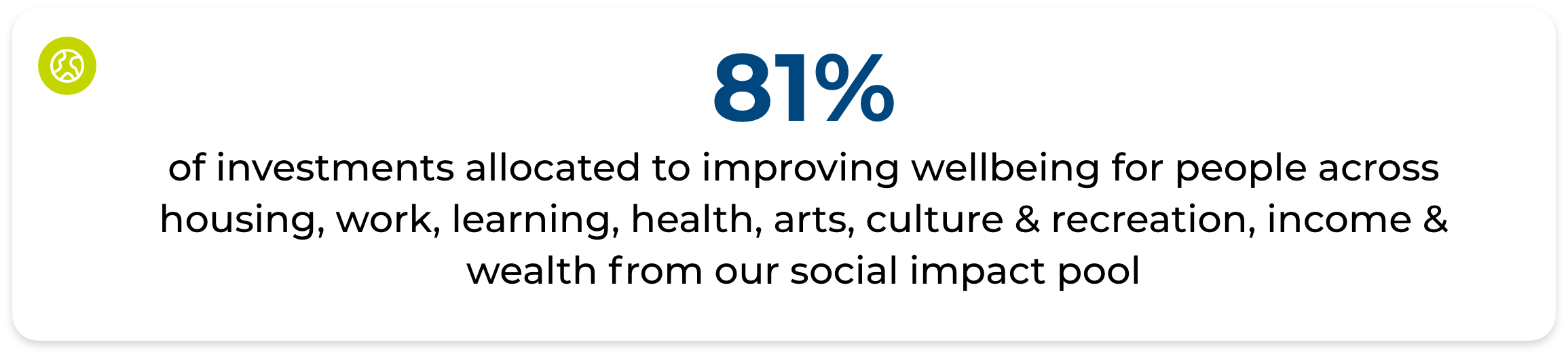

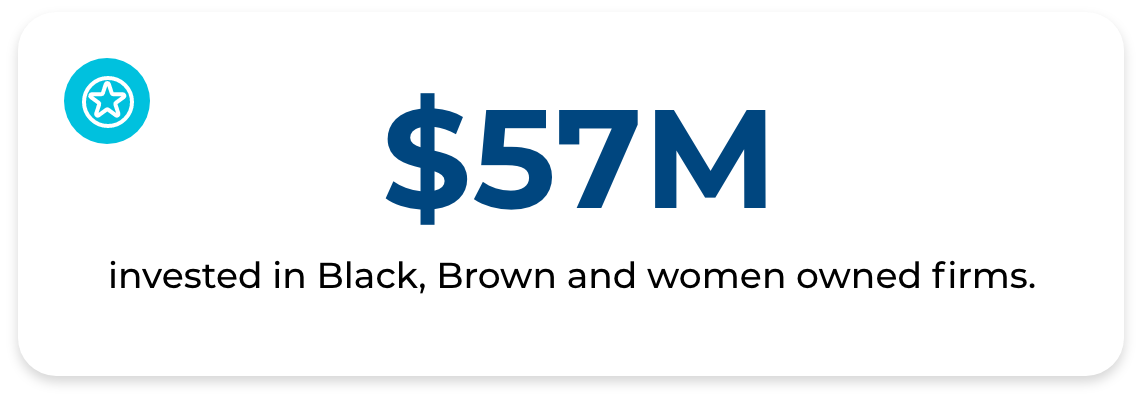

Investment Impact Snapshot

*The transition from a traditional portfolio to one invested responsibly typically spans several years. Because certain investments have been locked in for extended periods, it takes time to divest.

*The transition from a traditional portfolio to one invested responsibly typically spans several years. Because certain investments have been locked in for extended periods, it takes time to divest.

Investment-Focused Impact Report 2024

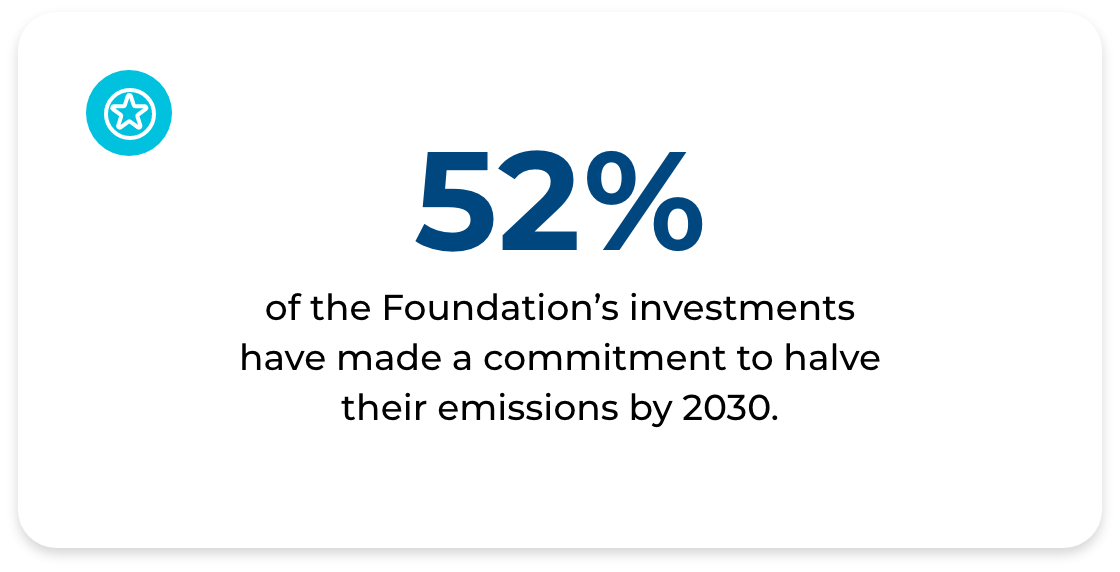

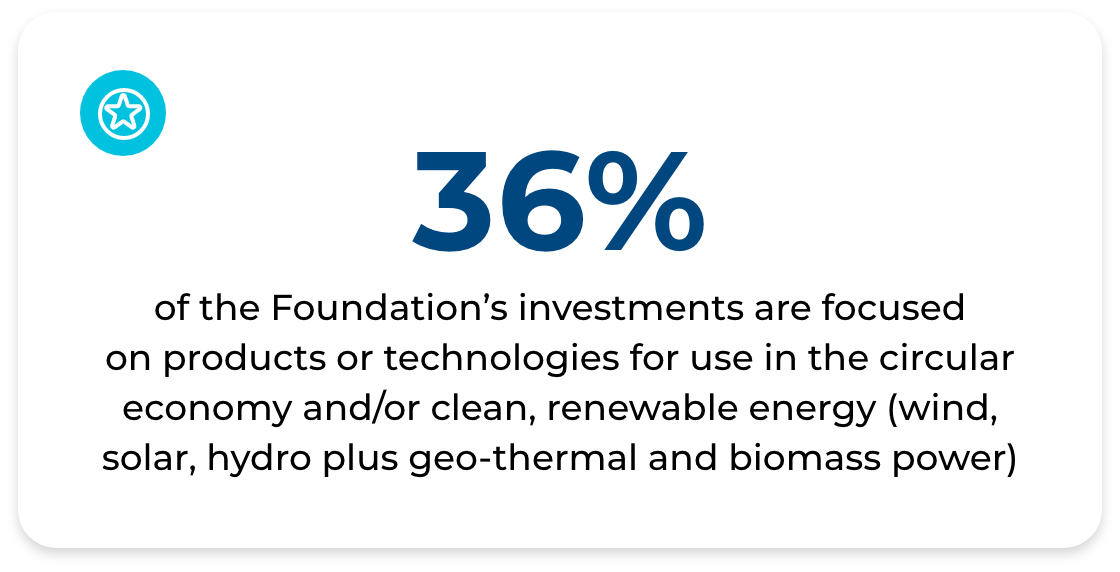

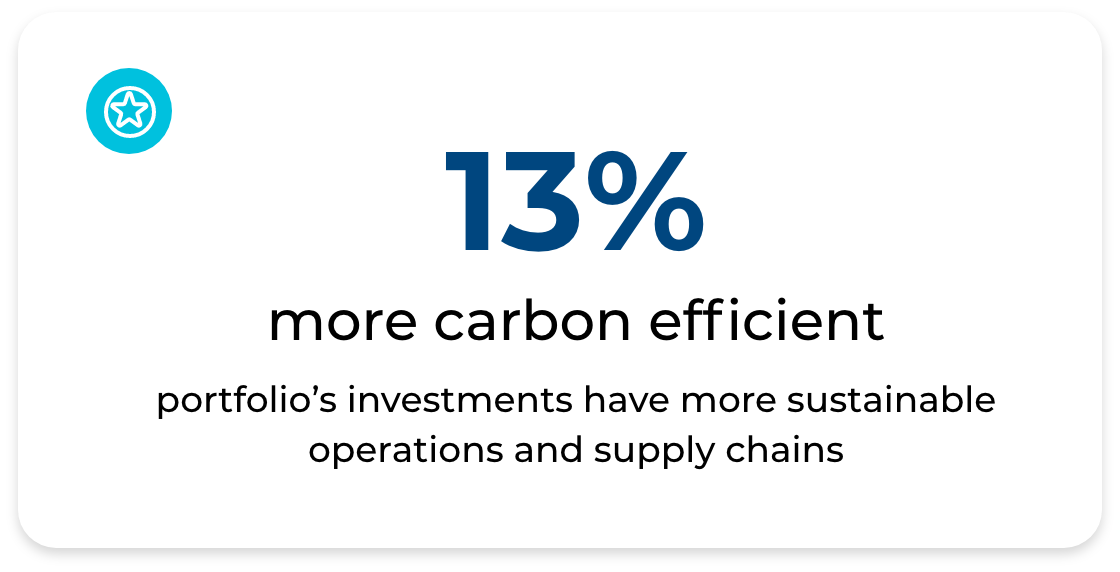

Planet

Planet Portfolio Investment Spotlight

Wyvern

Generate Upcycle

Clean Bus Solution

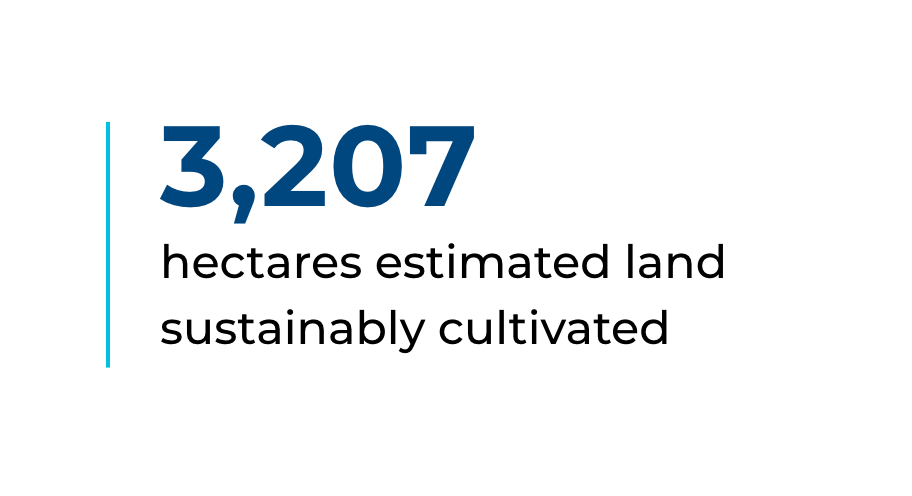

InvestEco

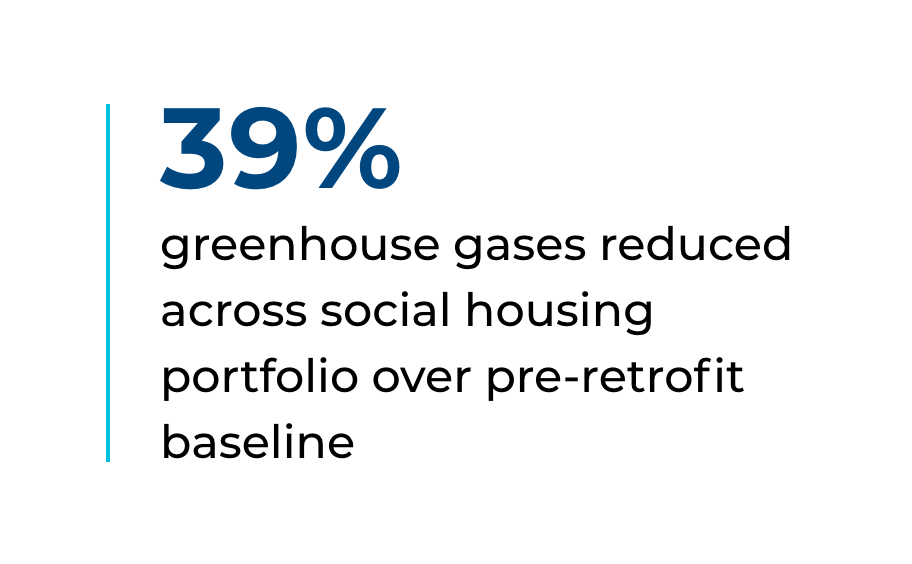

Efficiency Capital

Planet

Planet Portfolio Investment Spotlight

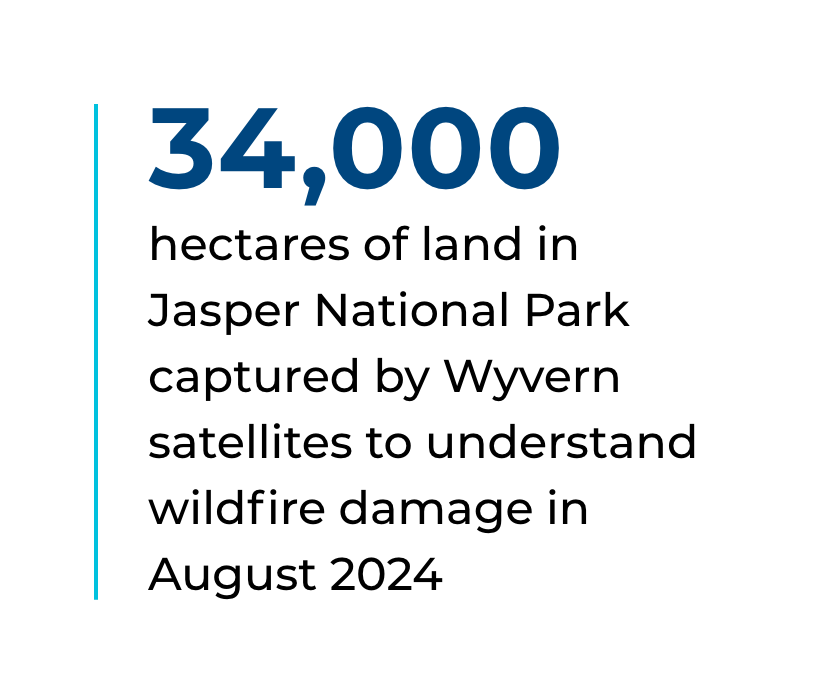

Wyvern

Generate Upcycle

Clean Bus Solution

InvestEco

Efficiency Capital

Planet

Planet Portfolio Investment Spotlight

Wyvern

Generate Upcycle

Clean Bus Solution

InvestEco

Efficiency Capital

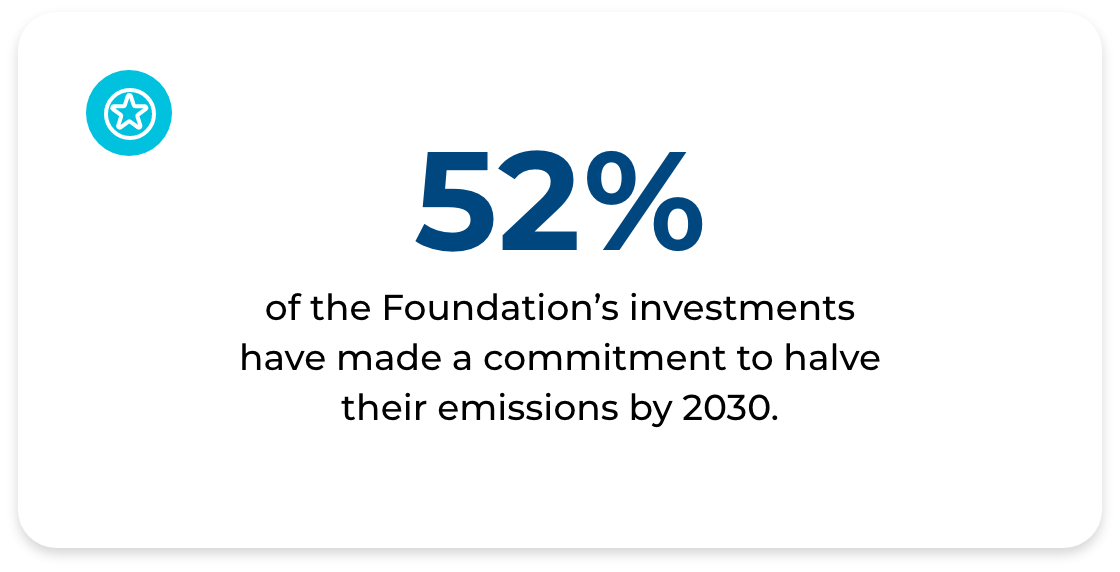

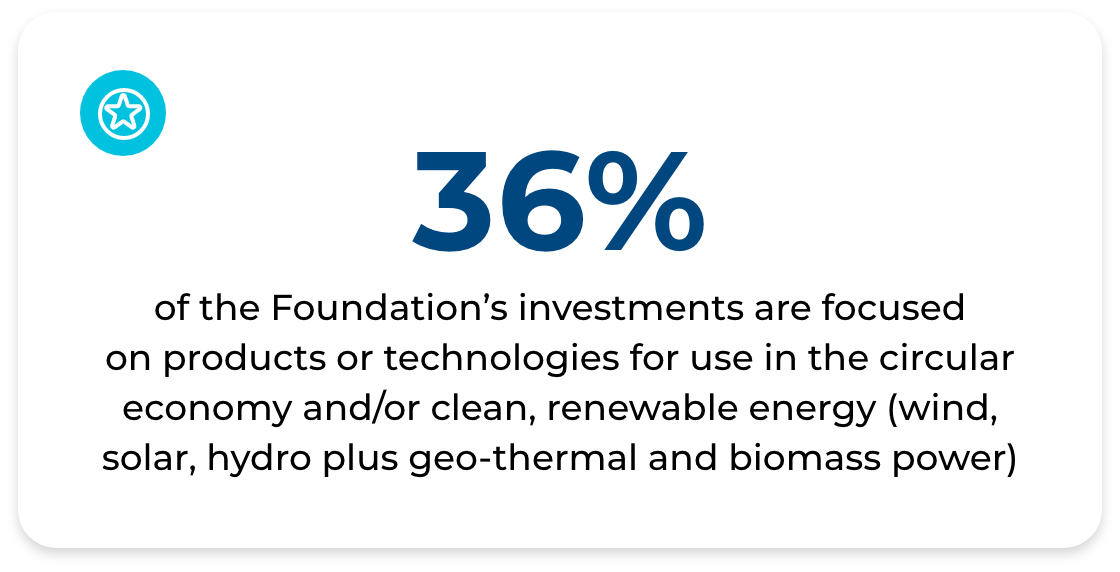

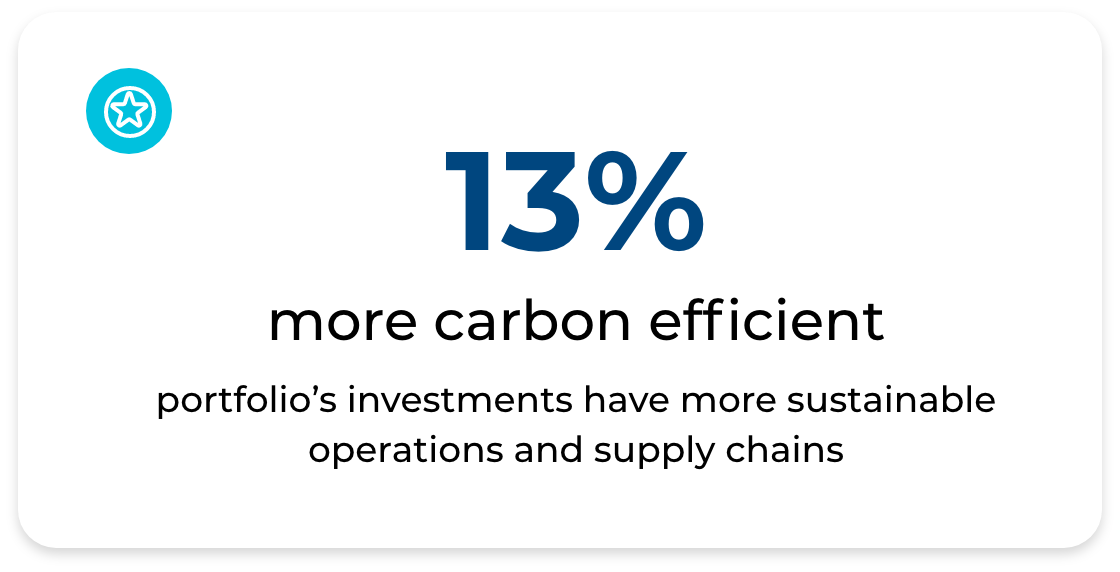

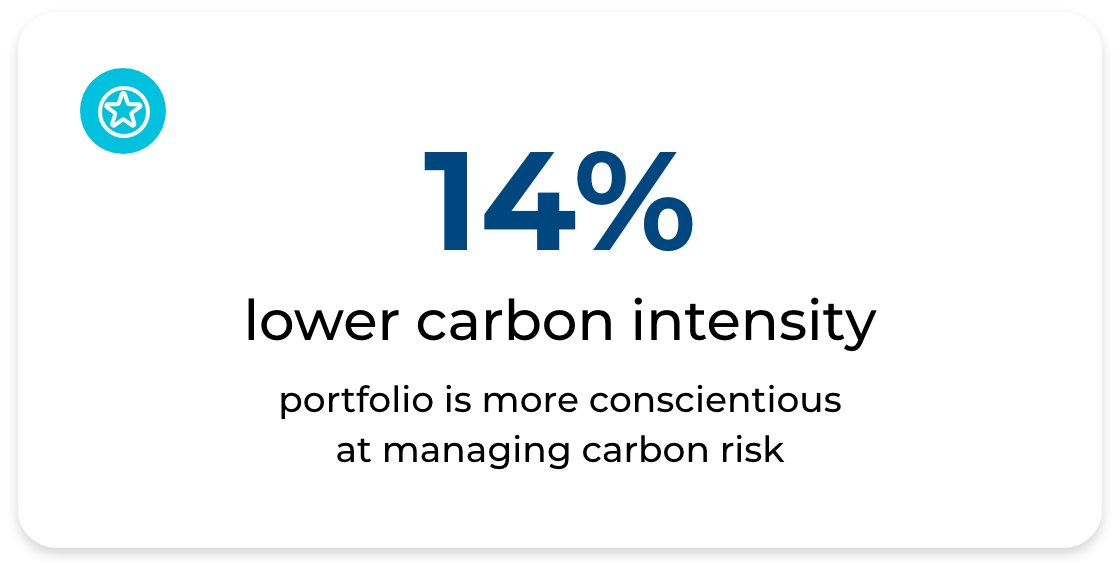

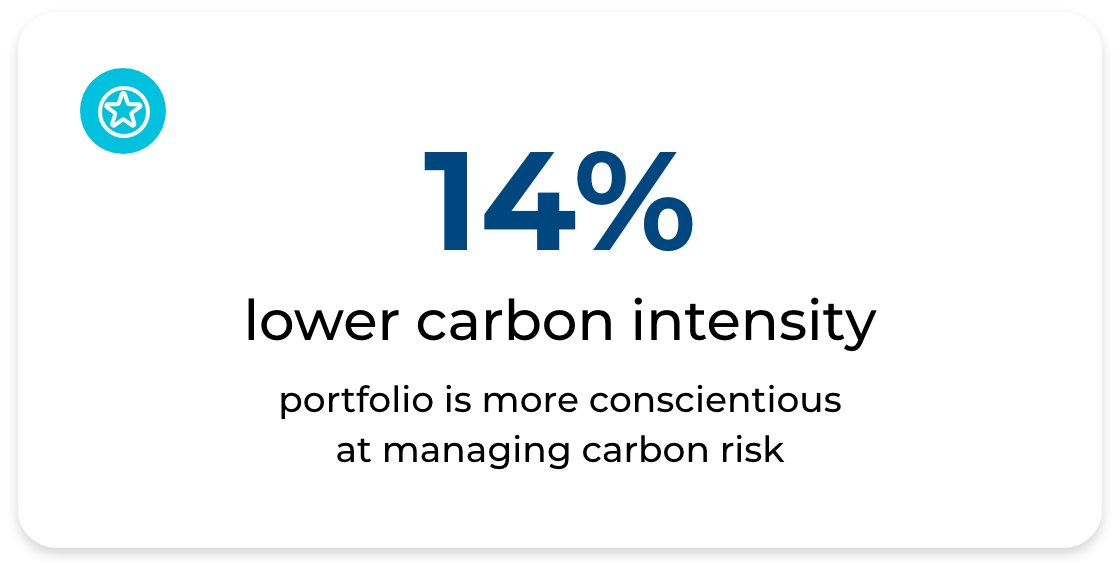

Toronto Foundation’s public portfolio vs. international benchmark:*

*MSCI All Country World Index (ACWI)

Toronto Foundation’s public portfolio vs. international benchmark:*

*MSCI All Country World Index (ACWI)

People

People Portfolio Investment Spotlight

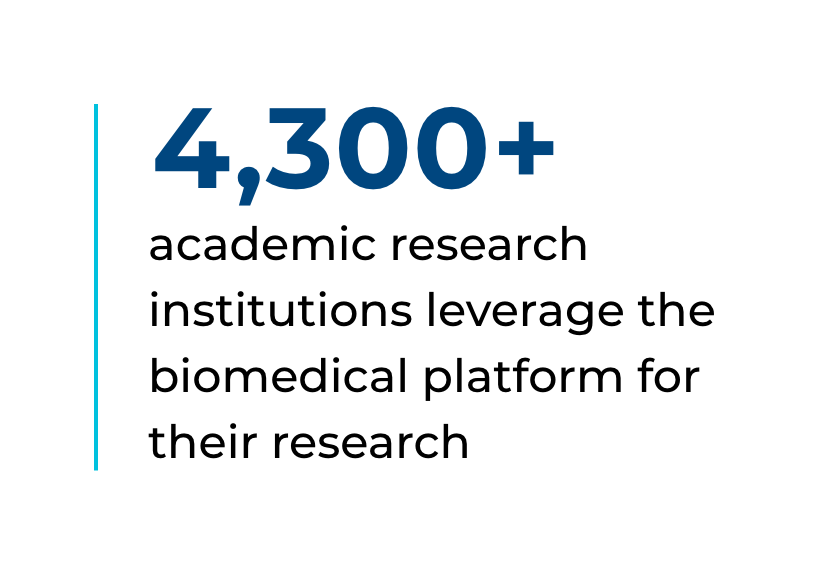

BenchSci

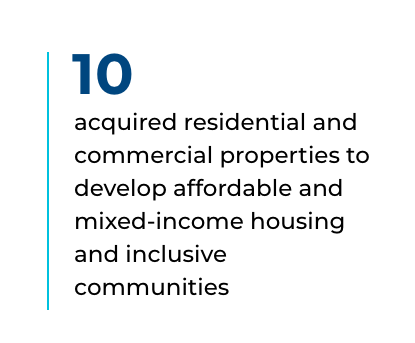

TAS

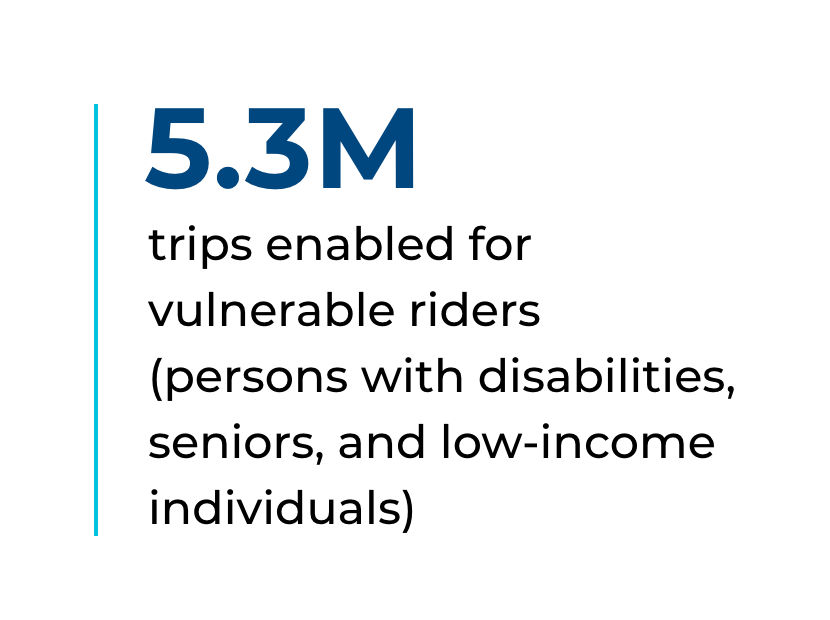

Spare

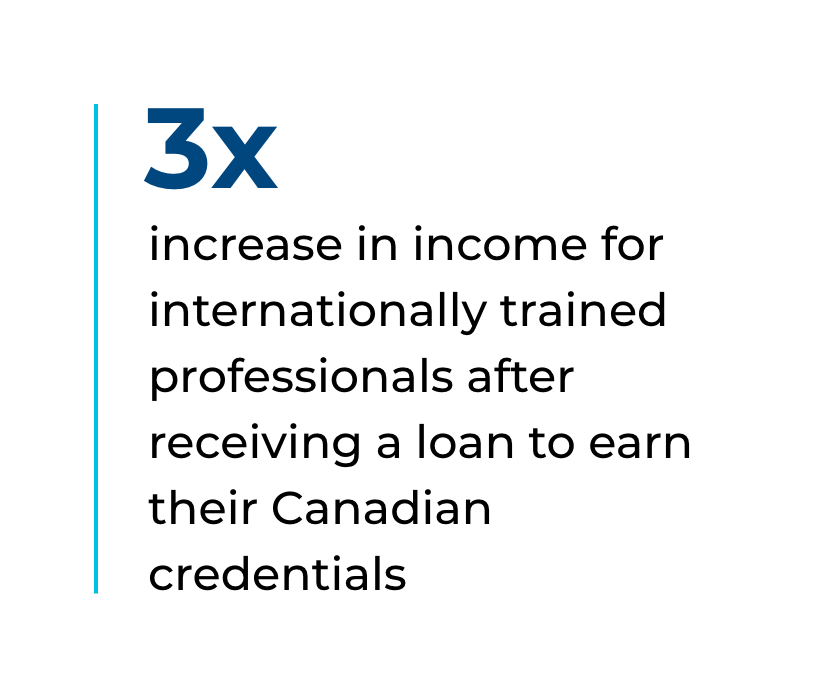

Windmill Microlending

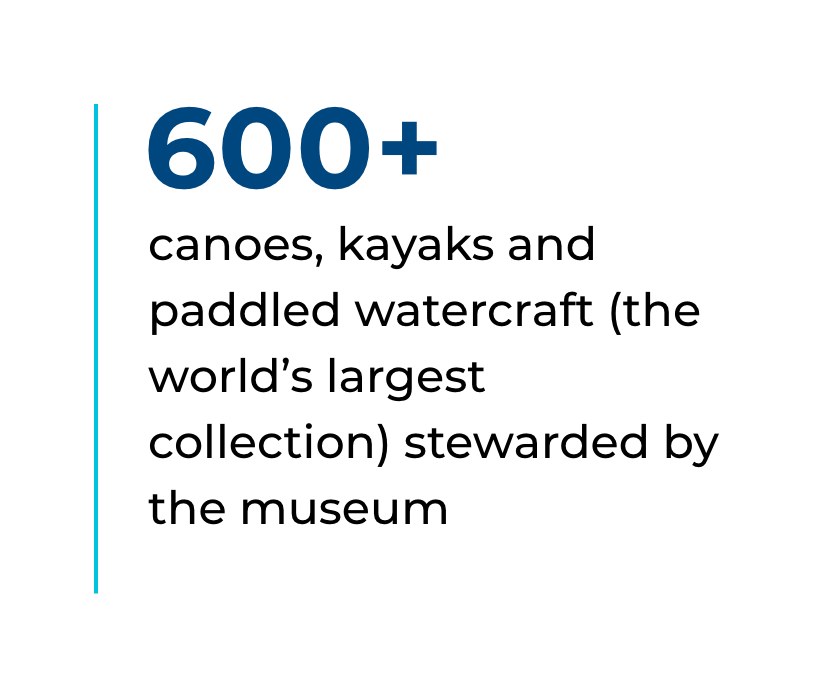

Canadian Canoe Museum

People

People Portfolio Investment Spotlight

BenchSci

TAS

Spare

Windmill Microlending

Canadian Canoe Museum