Financials

All numbers as of December 31, 2024

Financials

All numbers as of December 31, 2024

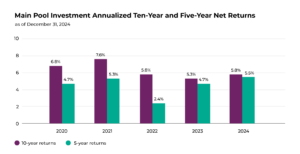

At Toronto Foundation we’re committed to leveraging our financial assets for maximum community impact through a socially responsible investment strategy that aligns with our values, while also generating strong returns. This allows us to drive positive change beyond granting. On this page we’re providing updates on the realization of that strategy as well as details on our financial performance for the year. In 2024 we saw a 14.6% net return on our investments. At the bottom of the page, you’ll find our summary financials as well as our financial statements.

We’re equally thrilled by both the financial and social impacts of our impact investing pool. Find more on that, as well as how donors can contribute to the Social Impact Investment Fund, here.

INVESTING: BALANCING SOCIAL RESPONSIBILITY WHILE OPTIMIZING RETURNS

RockCreek Canada acts as our Outsourced Chief Investment Officer (OCIO) with the mandate to meet both our return objectives and socially responsible investment goals. With oversight by our investment committee, RockCreek Canada considers factors such as environmental, social & governance (ESG) criteria, equity, diversity and inclusion standards, human rights practices as well as active ownership, impact investing and climate risk management at the time of an investment across the portfolio.

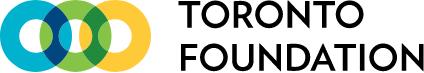

Optimizing Returns

We prioritize stable, at market investment returns over the long run, while maintaining the value of capital within acceptable risk parameters. Guided by our investment policy, we target an annualized net return of 7% after investment management fees, over a five-to-seven-year market cycle, to cover granting, operations and inflation. As of the end of 2024, the annualized five-year net return was 5.5%.

Putting more of our assets to use for good

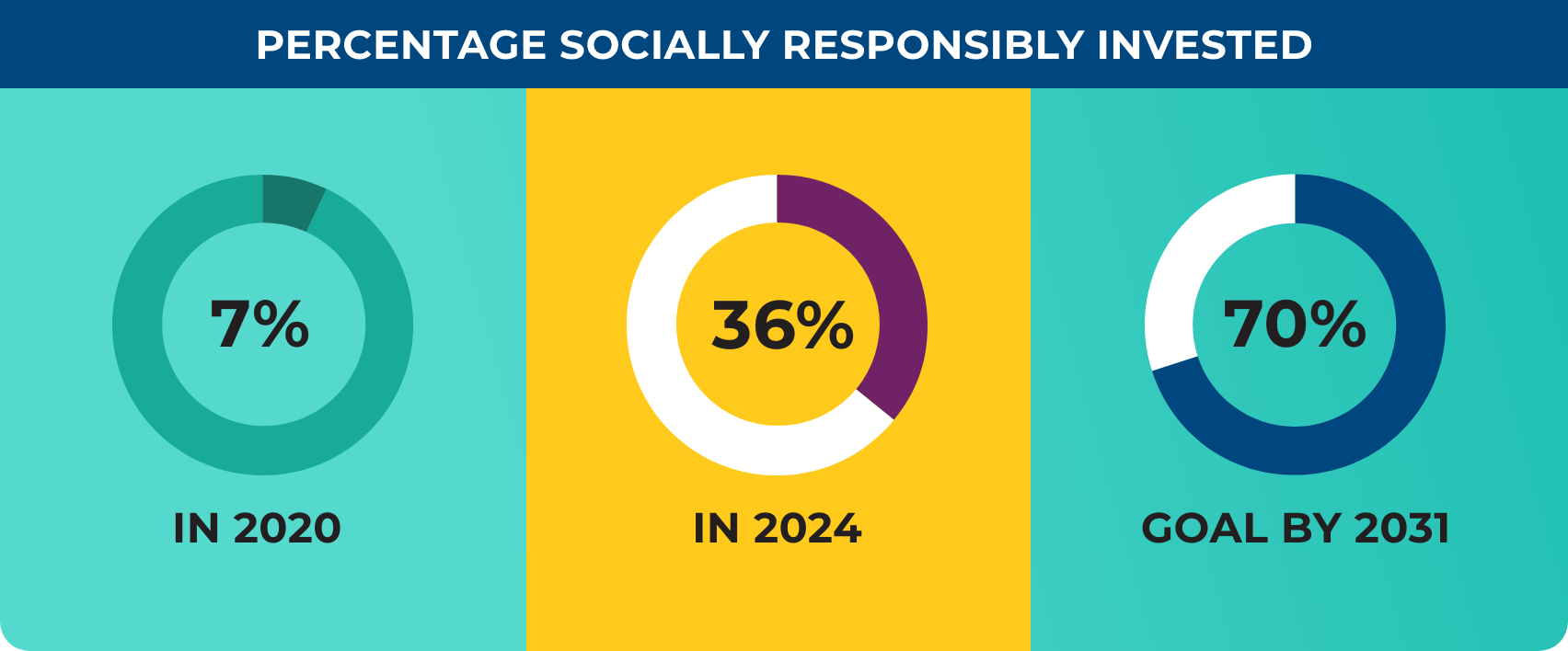

As we annually increase the percentage of our assets responsibly invested to our goal of 70%, we can confirm that our full portfolio already adheres to the principle of doing no harm.

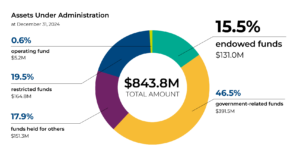

34%

(nearly $129M) of our main pool was invested in socially responsible investment products. This is up from 28.8% from 2023 and totals 36% of our assets when you factor in our social impact investing pool.

57%

of the portfolio was invested with fund managers that are signatories of the United Nations’ Principles for Responsible Investment or have environmental, social & governance (ESG) policies.

Less than 4%:

Our exposure to non-renewable energy and utility companies (a decrease in the total portfolio)*

Less than 1%:

Our portfolio’s exposure to alcohol, tobacco and firearms (ATFs)*

*We do not have any direct intentional investments in either non-renewable or ATF

Note that the transition from a traditional portfolio to one invested responsibly typically spans several years. This gradual shift is in part due to certain investments having been locked in for extended periods, so it takes time to divest. Look at our impact continuum to see what we mean by socially responsible investments.

Read our 2024 report on the social impact of our investments and more on our strategy.

Also read a 2024 reflection and 2025 lookahead from Outsourced Chief Investment Officer RockCreek Canada.

Read our 2024 report on the social impact of our investments and more on our strategy.

Also read a 2024 reflection and 2025 lookahead from Outsourced Chief Investment Officer RockCreek Canada.

Expand each of the sections below for a report back on the 2024 fiscal year.

Assets

Financial Summaries

Financial statements

MORE ON INVESTING WITH TORONTO FOUNDATION

MORE ON INVESTING WITH TORONTO FOUNDATION

Investing Policy

Our investment policy statement steers the management and investment strategy of our main investment pool. Both fundholders and other contributors, including other charities, pool their investments with us for maximum returns. This new simplified investment policy (effective March 2024) reflects the transition to the Outsourced Chief Investment Officer (OCIO), RockCreek Canada, onboarded in 2021. In the policy you’ll find an updated minimum annualized net return goal from 4.5% to 7% over five to seven years (a market cycle). This change reflects the increase in the disbursement quota to 5%, as well as our ambitions to grow our returns on our investments. Note: During 2024 all asset allocations remained within permitted targets and ranges as set out in our Investment Policy Statement.

Find the policy here.

Our Principles, Expertise and Governance

Curious to learn about how we invest our funds and what sets us apart? Watch the videos below to learn more about our investment expertise, governance, beliefs and principles. Each video explores key concepts that help you better understand how we manage investments and what you can expect as a fundholder. Whether you're a new fundholder or seeking a refresher, these resources will equip you with the insights you need.

Why a community foundation is different

Why a community foundation is different

Our expertise and governance

Our expertise and governance

Our beliefs and principles

Our beliefs and principles

You might also be interested in:

We acknowledge we are on the traditional territories of the Huron-Wendat, the Anishinabek Nation, the Haudenosaunee Confederacy and the Mississaugas of the Credit First Nation. While Indigenous communities in Toronto remain strong, vibrant, and resilient, they need support to address and overcome the impact of colonialism and systemic inequalities. Furthering Indigenous reconciliation and sovereignty are integral to achieving a more fair and just society where everyone can thrive.

We aim to be an ally and to fund local Indigenous organizations.